2 min read

The Open Performance Fund - Saving Businesses Millions on Energy

![]() True Powered by Open Energy Market

:

Feb 20, 2024 12:57:20 PM

True Powered by Open Energy Market

:

Feb 20, 2024 12:57:20 PM

Managing energy costs is a never-ending challenge for businesses.

Whether it’s surviving the record highs of the energy crisis or choosing the right time to buy in a falling and unpredictable market, it’s a high-stakes decision fraught with risk.

To help you and your team understand more about the potential savings you could make on energy, we're offering support to UK businesses from a team of energy traders and market experts. You can take the fund challenge for free, here.

The Open Performance Fund is a solution to beating the market in both a rising and falling market.

The fund saves our customers millions of pounds every year and removes the stress and hassle of dealing with energy markets and price fluctuations.

The secret ingredient to success is taking a longer-term buying strategy executed by an industry-leading team of energy traders.

You can read all about their success to date in the media, here.

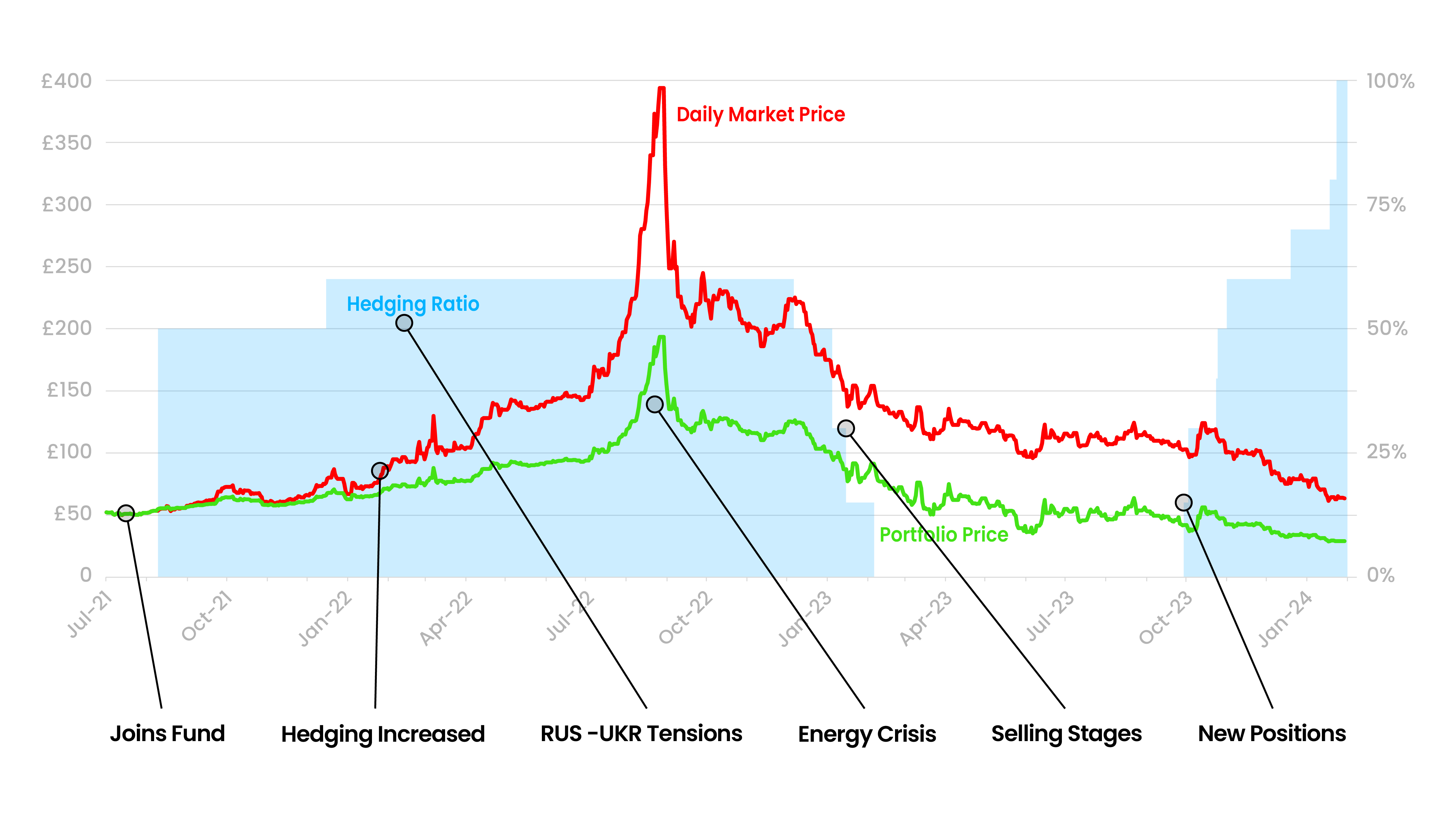

This graph illustrates how one of our customers has benefited from the Open Performance Fund for Power.

The green line shows their portfolio price in relation to the market price (red) and the blue blocks show the hedging ratios.

1. Customer Joins Open Performance Fund

In July 2021, a new customer joined the Open Performance Fund. Hedging ratio for Summer 24 is 0% at this point in time.

2. Trading Team Begins Hedging

As energy prices begin to rise during the purchasing period for summer 2024, our trading team increase hedging ratio to 50%.

3. Tensions Rise Between Russia and Ukraine

As tensions between Russia and Ukraine increase and prices show signs of rising, our trading team increase hedging to 60% in January 2022.

4. The Energy Crisis Ensues

Thanks to the foresight and understanding of the energy market, the customer portfolio remains well below the market throughout the worst of the energy crisis. The customer was protected against high prices and was able to protect jobs and its growth.

5. Energy Prices Start to Drop and Selling Begins

As the market showed signs of falling, our traders begin to sell back to the market in stages, between December 2022 and February 2023. They secure a hedging ratio of 0% on March 2023, ensuring the customer's portfolio continues to beat the market even when it's falling.

6. Trading Team Takes New Positions

In October 2023, with the summer season fast approaching, the trading team begins to take trading positions again. As a result of trading between October and February, the customer benefits from prices that are lower than market cost, even when it is falling.

The Long-Term Approach Pays Off

This was only possible because the customer decided to take a longer-term buying strategy and joined our fund, benefiting from the experience and expertise of our trading team to navigate through a rising and a falling market.

Want to know how much you could save?