1 min read

UK Energy Market Analysis - April

![]() True Powered by Open Energy Market

:

May 3, 2024 5:32:47 PM

True Powered by Open Energy Market

:

May 3, 2024 5:32:47 PM

In the economic environment, equity markets have shown only a modest response to the tense geopolitical situation, with the FTSE 100 trading close to its recent all-time high at 8,150 points. Attention remains on inflation, particularly with the contrasting trends between the US and Europe, which are expected to prompt the ECB and the Bank of England to cut interest rates sooner than the Federal Reserve, potentially strengthening the US Dollar. Despite concerns, the eurozone economy surpassed forecasts in the first quarter, driven by Germany's return to growth and robust expansion in Spain.

Volatility in oil markets has increased, with Brent crude fluctuating between $86 and $92 per barrel due to ongoing supply risks from the Middle East and Russia. While the renewal of OPEC+ production cuts and signs of demand recovery in the US and China have provided some support, recent increases in US inventories and weaker-than-expected global demand have tempered optimism.

In the gas sector, supply fears stemming from conflicts in Ukraine and the Middle East have elevated the risk premium on forward contracts. Factors such as cold weather and unplanned outages have supported short-term markets, resulting in a slight decrease in European gas storage, which, although still at an all-time high for this time of year (currently at 62.6%), has seen injections resuming.

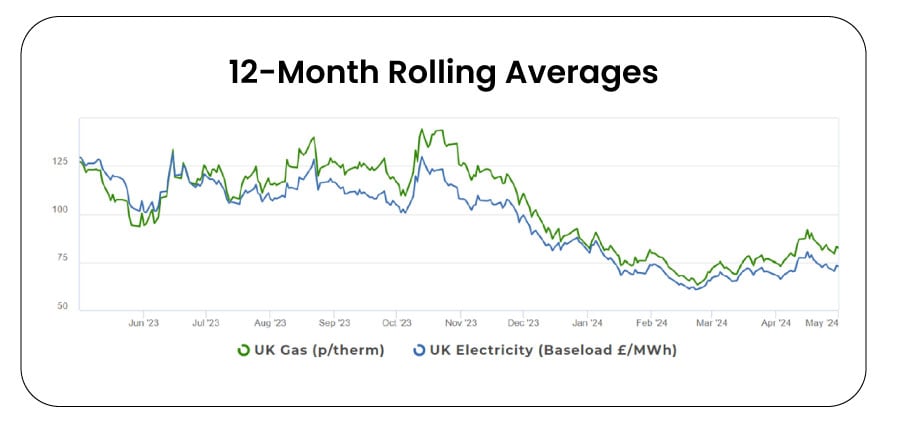

The rise in gas market volatility has impacted electricity contracts in the UK, with prices for Winter 24 rising from £72.75/MWh in early April to £88.00 on April 16th (currently at £82.00). Recent temperature fluctuations in Europe, from below seasonal values to forecasts indicating a warmer-than-average start to May, have also influenced market dynamics. Additionally, strong renewable and nuclear output in France, coupled with low demand due to bank holidays, are expected to drive significant exports to neighboring countries in the coming weeks.

(CLICK HERE TO SEE HOW OUR OPEN PERFORMANCE FUND PERFORMED AGAINST THE MARKET)

Looking ahead, despite continued geopolitical tensions in regions such as the Red Sea and the Indian Ocean, the risk premium in oil markets has decreased, with the front-month Brent contract trading at $83.50 per barrel, its lowest level since late March. While long-term gas contracts typically follow suit, short-term prices have been supported by maintenance activities in the North Sea and the outage at Freeport LNG. However, a significant increase in Norwegian output and the arrival of the first cargoes from Freeport LNG, barring major disruptions from other major suppliers, are expected to lead to price decreases again by mid-month.

Get in touch with our trading team and join the fund, today.