2 min read

UK Energy Market Analysis - March

![]() True Powered by Open Energy Market

:

Apr 3, 2024 10:19:36 AM

True Powered by Open Energy Market

:

Apr 3, 2024 10:19:36 AM

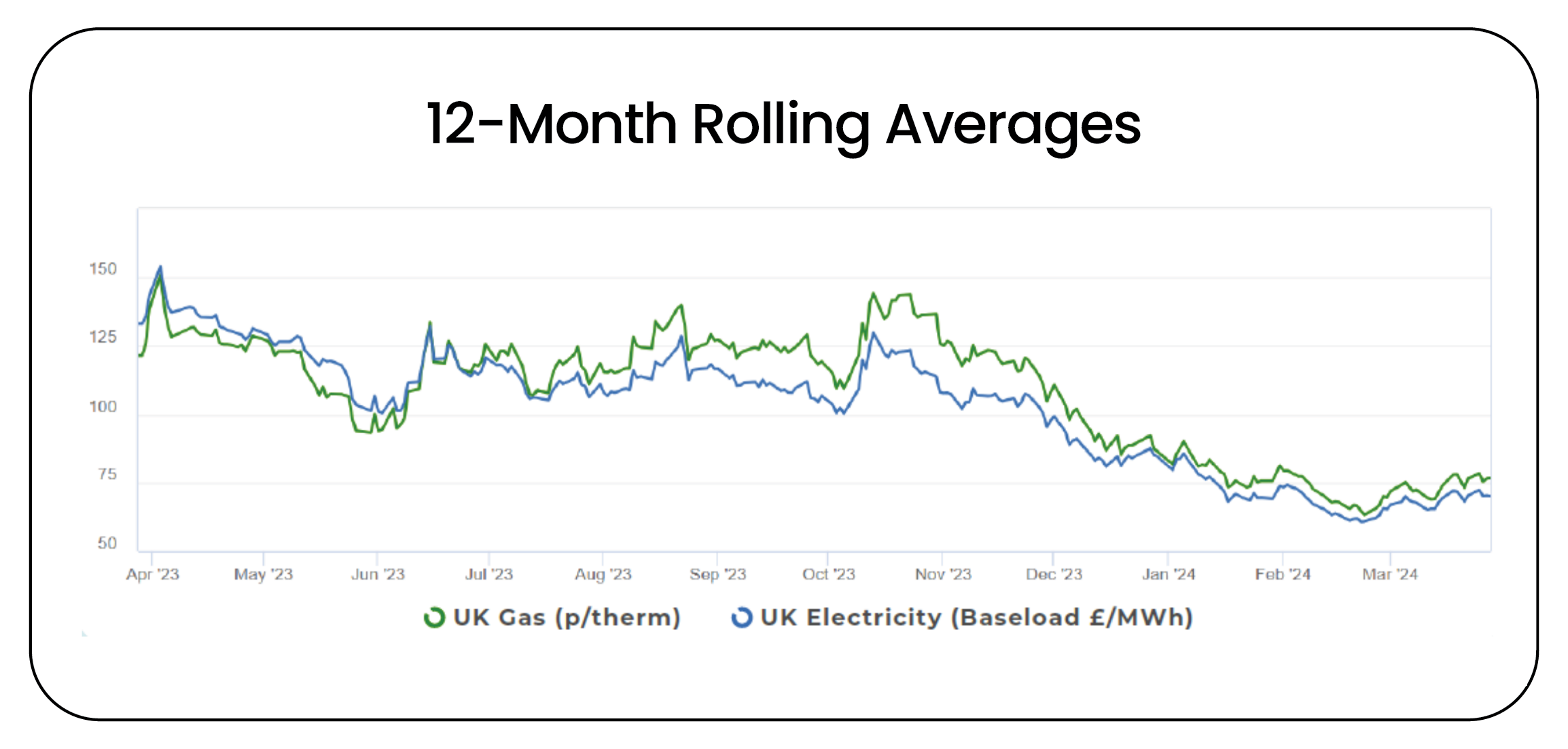

The last month has seen the UK move – officially – out of the winter period and into spring, and the official winter was bookended with what has come to define this winter: more warm and windy weather conditions. With the exception of a couple of cold spells in late November and early January, temperatures have generally been above seasonal norms and wind generation has been consistently strong. This has been the predominant driver of prices throughout the last 6 months, and one of the main reasons why prices have fallen so significantly.

When we also consider the ongoing weakness in industrial and manufacturing demand, with an estimated 18% decrease against the 2017-2021 average in European gas demand for the month so far, it is clear to see that the risk premiums factored into Winter-23 pricing did not come to pass and spot market prices have out-turned significantly below their forward counterparts. However, despite this ongoing weakness, the last month did see some periods of bullish pressure with prices increasing from mid-February to mid-March. This came on the back of a number of short-term factors which shouldn’t – in themselves – cause a significant reversal of the overall bearish trend seen over the winter period.

The market increases came due to low nuclear output in both France and the UK, unplanned gas productions outages in the North Sea and maintenance at Freeport LNG, a large LNG export terminal in Texas, US. As expected, due to the short-term nature of these factors, prices have again subsided and retreated from their near-term highs. The Summer-24 gas contract reached a peak of 74.50 p/therm, before retreating to around 69.43 p/therm last week. The power contract reacted similarly with a price of c.£63/MWh last week compared to a peak of £67/MWh earlier this month.

.webp?width=2308&height=1103&name=12-Month_Rolling_Averages_(March2024).webp)

While the fundamentals of the market remain very healthy – European gas storage levels remain at all-time record highs for this time of year (currently at 58.72%), an expectation of limited economic growth and an increase in LNG from the US – there do remain some significant upside risks which could have a material impact on prices.

(CLICK HERE TO SEE HOW OUR OPEN PERFORMANCE FUND PERFORMED AGAINST THE MARKET)

Overall, the OEM trading team remains cautiously bearish: even with an interruption to the Russia-Ukraine transit of gas, European countries mostly affected have in place alternate supplies and with an increase in LNG from the US and Qatar, any upside should be limited. However, as is always the case with the energy markets, the biggest risks often come from the ‘unknown unknowns’: the factors which are not yet in focus but could affect availability of European gas and power.

It remains more important than ever that customers use the current opportunity to start assessing the market and ensuring they are in a position to react to any market developments quickly: either through the use of fixed or flexible contracts, or by ensuring your fund contracts are extended to allow an ideal 36 month purchasing horizon.

Get in touch with our trading team and join the fund, today.